Guild’s guide to a risk free holiday season.

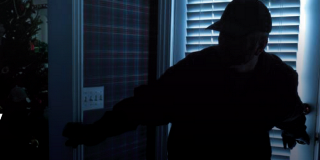

With the holiday season approaching, it's time to remind ourselves of the possible threats to our homes and cars during this time. In the lead up to what should be a fun and festive time with loved ones, it's important to think about what you can do to protect your valuable assets during this period. Thefts and burglaries increase at this time as a lot of crime is opportunistic; thieves know that houses and cars ...

break-in

Travelling with kids.

Travelling with children is a great opportunity to spend quality time together and create shared memories. However, it does require some extra planning to ensure you’re prepared for the journey and the common risks you might encounter. Next time you travel with children, keep these 10 tips in mind. Before you go Check that everyone’s passports are valid with at least 6 months left before the expiry date. Speak to your doctor to see if ...

insurance